You can submit the Tax return by anyone of the following way :

- Income tax paper form

- Tax Aasaan Application / Tax Asan Application

- income tax return available on Iris.fbr.gov.pk

|

| Income Tax Return online |

|

| Iris.fbr.gov.pk |

- What informations /data/ details required for filing income tax return 2022 on iris fbr.gov.pk?

All the following documents are required for a period from :

01- July 2021 to 30 - June 2022

1) income statement/ salary slips

2) Other Sources of income, for example:

a) Agriculture Income

b) Rental Income

c) Foreign Remittance

d) Silent Partner Income

3) Bank account/s statements

Balance on the 30Th june is important to enter in the form.

4) Income Tax deduction Certificate/ Slips/ Sources

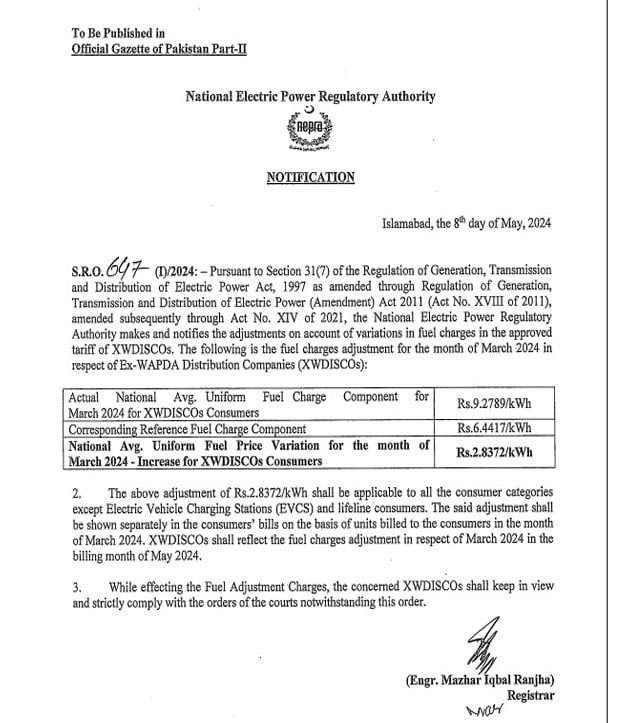

5) Withholding tax deduction source, for example

Electricity Bill, Telephone bill, Mobile internet bill etc.

6) Utilities Expenditure Statements:

a) Electricity Bill

b) Telephone Bill

c) Sui Gas Bill

d) Internet Bill

e) Water Bill

f) Cable Bill

7) Educational Expenses

Slips/ Online Transfer screen grabs etc

8) Asset Details

a) Immovable properties

b) Investment

c) Gold, Ornament,

d) Prize Bonds

e) Saving Certificates

f) moveable Asset (Vehicle/motor car, motorcycle, etc)

g) House hold Precious Items

(Furniture etc)

h) Cash in hand (non investment money)

i) Asset purchased on

.png)

.jpg)

.jpeg)

No comments:

Post a Comment

Please Comment with your ID and "Check" the Notify "button" so that you can get reply intimation.